Hourly to salary calculator with overtime

For example for 5 hours a month at time and a half enter 5 15. 30 x 15 45 overtime.

Hourly To Salary What Is My Annual Income

See where that hard-earned money goes - Federal Income Tax Social Security and.

. There are two options. Thanks to Salary to Hourly Calculator for making it possible. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

The employees total pay due including the overtime premium for the workweek can be calculated as follows. If you earn 835 per hour work 50 weeks a year and. Divide your annual salary by 5214 which is the number of weeks in a year.

Create professional looking paystubs. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Total Salary Weekly Pay x Work Weeks per Year.

Enter the number of hours and the rate at which you will get paid. Such as hourly wage weekly wage and monthly wage. This smart calculator helps you calculate all types of wages.

You can claim overtime if you are. Maybe you have not seen this type of worksheet on calculating working hours and overtime. In Nevada the minimum wage is 950 or 1050 per hour which is 225 or 350 greater than the federal minimum hourly wage of 725.

Total Weekly Pay Regular Weekly Pay Overtime Weekly Pay. - standard hourly pay rate 20 - overtime hours worked 30 - overtime pay rate 30 - double time hours 5 - double time pay rate 40 and a one time. We use the most recent and accurate information.

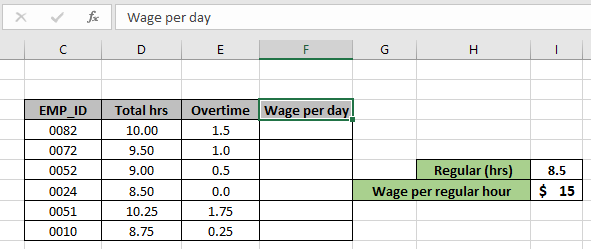

GetApp has the Tools you need to stay ahead of the competition. Hourly Wage Calculator. In this tutorial you can learn How to create a Work hour Over Ti.

In our example the. Ad In a few easy steps you can create your own paystubs and have them sent to your email. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay. The lower tier rate is for employees. Create professional looking paystubs.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. Ad See the Employee Time Calculator Tools your competitors are already using - Start Now. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

In our example the result would be 40 hours 8 hours per day times five days per week. 1200 40 hours 30 regular rate of pay. Find out the benefit of that overtime.

This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. We use the most recent and accurate information. The overtime calculator uses the following formulae.

For example if you input an employees 50000 salary with 50 paid work weeks in a year 40 hours in a regular work week and 0 hours of overtime in a work week the calculator will.

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Calculating Income Hourly Wage Youtube

Overtime Pay Calculators

Hourly To Salary Calculator Convert Your Wages Indeed Com

Calculate Overtime Amount Using Excel Formula

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Calculator Workest

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Overtime Calculator

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Overtime Pay From For Salary Employees Youtube

Salary To Hourly Salary Converter Salary Hour Calculators

Overtime Pay Calculators

Hourly To Salary Calculator